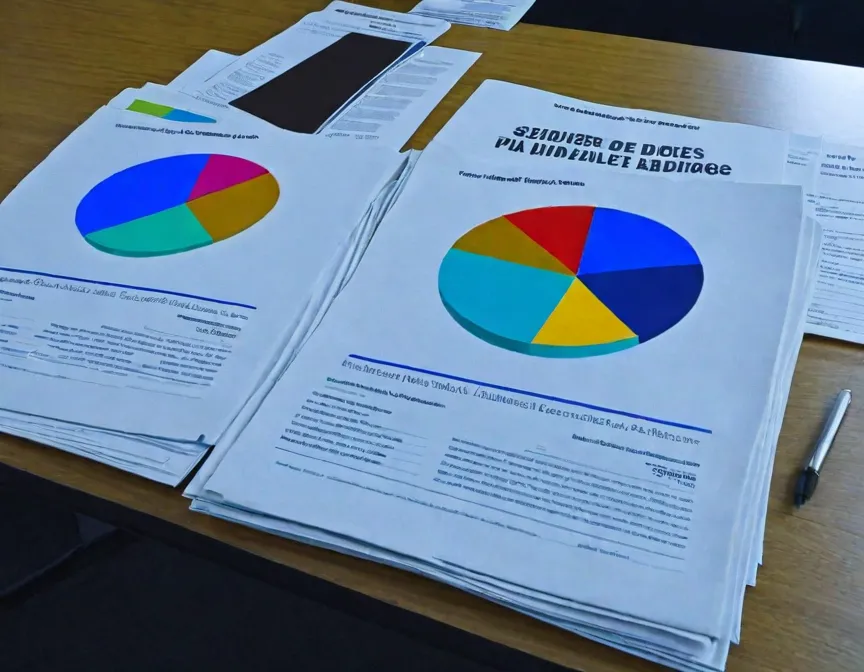

Learn about Equities Inside and Out

Ebitday's Equities Education provides a diverse curriculum covering foundational concepts to advanced strategies. Gain mastery over equity markets, refine your investment skills, and make strategic decisions with confidence.

Securities: Privately Held Firms

Delve into privately held firms—understand shareholder limits, fundraising nuances, and the evolving trading landscape in a straightforward exploration.

Securities: Introduction to Financial Markets

Discover the dynamics of financial markets, from direct search to auction, including brokered, dealer, and electronic systems. Explore the evolution of market organization.

Securities: Publicly Traded Companies

Explore the dynamics of private-to-public transitions—dive into IPOs, underwriters, and seasoned equity offerings. Understand pricing complexities and underpricing in the world of publicly traded companies.

Securities: Equity Market Order Types

Explore order dynamics—market orders executed instantly, price-contingent orders with limits, and stop orders to control losses or initiate gains in the stock market.

Securities: Margin Trading

Explore margin trading—grasp the dynamics, risks, and benefits of leveraging investments in securities.

Securities: Short Selling in the Stock Market

Dive into short selling—a strategy profiting from stock declines. Grasp mechanics, regulations, and controversies in this insightful examination.

Mutual Funds: Types of Mutual Funds

Explore mutual funds: Bonds for stability, equities for growth. Navigate risks with expert insights for informed investing.

Mutual Funds: Prospectus Evaluation

Evaluate mutual fund objectives, management, risks, and fees. Learn how to make informed investment decisions with a prospectus.

Mutual Funds: Features, Benefits, and Drawbacks

Discover Mutual Funds: Features, benefits, drawbacks, and differences from hedge funds, index funds, and ETFs.

Solvency Analysis: Financial Leverage

Learn how the Financial Leverage Ratio assesses a company's risk and fiscal balance in this concise guide.

Solvency Analysis: Total Debt Ratio

Understand the interpretation and calculation of the Total Debt Ratio, exploring its role in evaluating a company's debt financing and solvency.

Solvency Analysis: Times Interest Earned

Assess a company's financial health with the Times Interest Earned ratio, gauging its ability to cover interest payments and make informed investment decisions.

Solvency Analysis: Fixed Charge Coverage Ratio

Gauge a company's ability to handle fixed expenses with the Fixed Charge Coverage Ratio

Solvency Analysis : Debt to Equity Ratio

Assess a company's financial health and risk by comparing its own funds to borrowed money with the Debt-to-Equity Ratio.

Solvency Analysis: Debt to Capital Ratio

Evaluate a company's financial risk with the Debt-to-Capital Ratio, indicating the proportion of borrowed money to its own savings.

Solvency Analysis: Cash Interest Coverage

The Cash Interest Coverage Ratio gauges a company's capacity to pay its debts by assessing if it has sufficient cash to cover interest payments.

Solvency Analysis: Cash Flow Coverage

The Cash Debt Coverage ratio measures if a company can cover loan repayments using its cash flow.

Profitability Analysis: Return on Equity (ROE)

ROE gauges a company's profitability by comparing its earnings to the investment, helping investors assess its financial performance and value.

Profitability Analysis: Return on Assets (ROA)

ROA measures a company's effectiveness in generating profits from its assets, aiding investors in assessing overall financial performance.

Profitability Analysis: Return on Total Capital

ROTC assesses how efficiently a company generates profit for its contributors, indicating its financial performance and overall value.

Profitability Analysis: Profit Margin

Profit Margin measures a company's ability to retain profit from its revenue after expenses, providing a snapshot of its financial performance.

Profitability Analysis: Operating Margin

Operating Margin reflects a company's profitability from its primary activities, revealing how well it manages costs and generates profit.

Profitability Analysis: Gross Margin

Gross Margin indicates how efficiently a company manages costs in relation to sales revenue, reflecting its ability to generate profit from its core operations.

Profitability Analysis: Basic EPS

Basic Earnings per Share (BEPS) indicates a company's profit per share, reflecting its profitability on a per-share basis.

Performance Analysis: Operating Leverage

Operating leverage shows how fixed costs affect profits, indicating the impact of sales changes on a company's financial performance.

Liquidity Analysis: Cash Burn Rate

Cash Burn Rate, essential for startups, indicates how fast a company spends money, influencing its survival period and funding decisions.

Liquidity Analysis: Defensive Interval

The defensive interval exposes a company's financial strength, indicating how long it can operate without new funds—essential for assessing stability.

Liquidity Analysis: Cash Conversion Cycle

The cash conversion cycle gauges a company's efficiency in turning investments into cash, offering insights into financial and operational effectiveness.

Liquidity Analysis: Working Capital

Working capital, the difference between a company's assets and liabilities, reflects its financial health and ability to sustain operations.

Liquidity Analysis: Quick Ratio

The quick ratio evaluates a company's immediate debt-paying ability, excluding stock, providing insights into short-term financial strength.

Liquidity Analysis: Current Ratio

The current ratio gauges a company's ability to cover short-term debts, with a higher ratio signaling financial health.

Credit Analysis: Altman Z-Score

The Altman Z-Score assesses the risk of financial distress and bankruptcy by analyzing five key financial ratios.

Valuation Metrics: Price-Earnings Growth Ratio (PEG)

The PEG ratio gauges a company's investment potential by comparing its earnings growth to stock price, considering industry factors and economic conditions.

Valuation Metrics: Price-to-Sales Ratio (P/S)

P/S Ratio assesses company value relative to revenue, providing insights into market perception.

Valuation Metrics: Price-to-Free Cash Flow (P/FCF)

P/FCF Ratio evaluates a company's stock value based on its ability to generate free cash flow, providing insights for investment decisions.

Valuation Metrics: Price-Earnings Ratio (P/E)

P/E Ratio assesses a company's stock value by comparing its market price per share to earnings per share, offering insights for investment decisions.